Our Forex Spread Betting Diaries

Wiki Article

The smart Trick of Forex Spread Betting That Nobody is Discussing

Table of ContentsThe smart Trick of Forex Spread Betting That Nobody is Talking AboutSome Ideas on Forex Spread Betting You Need To KnowThe Forex Spread Betting StatementsSome Known Details About Forex Spread Betting

This is just how much you can make or lose on a spread bet for every point of movement in the rate of the market. It is additionally referred to as the stake dimension. This describes the closure of a setting, and the result establishes whether you have actually made a revenue or a loss.

throughout bouts of severe volatility, when rates relocate sharply up or down. The spread is the difference in between both prices priced quote on every spread bet: the buy as well as sell price for the exact same asset. Usually reduced to DFB, this term describes a placement that stays open up until you decide to close it.

Some Known Details About Forex Spread Betting

If you believe a property is going to increase in rate, you can buy a placement in that possession through a spread bet. By contrast, if you assume the price is going to fall, you can market the spread bet.

A margin telephone call is made when the equity in your account the complete funding you have deposited plus or minus any kind of earnings or losses drops below the minimum need. If this holds true, there is a threat that the broker will immediately shut your placements, possibly leaving you with losses.

The spread is the difference in between a broker's sell and also acquire (proposal and also offer) costs. This is exactly how the broker makes its earnings. The hidden asset's worth will certainly remain in the middle of these 2 costs. If the FTSE 100 index is at 7100, a spread-betting company may estimate a spread of 70997101.

Getting The Forex Spread Betting To Work

Generally, the smaller sized the spread the better, as you require the cost to move less in your instructions prior to you begin earning a profit. There are a number of spread-betting methods that can be released. See to find out more on approaches and also a large range of additional educational product.Arbitrage entails the simultaneous acquisition as well as sale of the same possession in various markets in order to benefit from small distinctions in the rate. Spread betters do this when short-term actions by buyers and also vendors at a certain broker vary from those at another, resulting in different costs (forex spread betting). While the quotes listed on broker web sites reflect the hidden cost motions in the tools they are based on, they are not constantly identical.

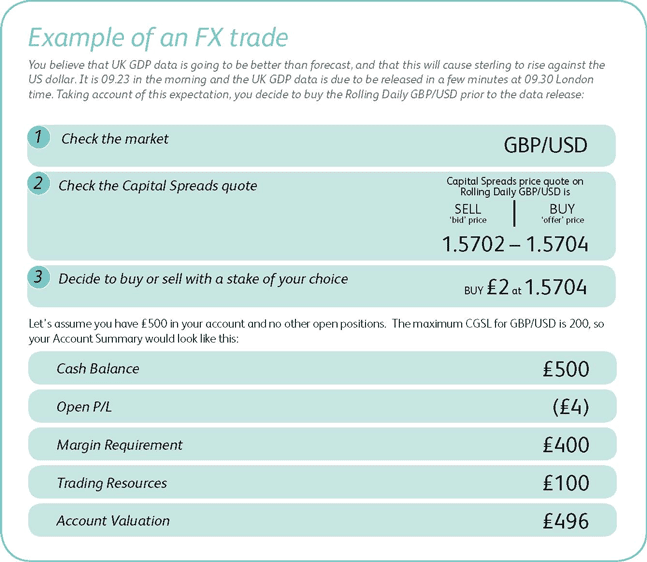

This approach includes trading based on information as well as market assumptions, both previously and also visit homepage complying with news releases. You will certainly have to act promptly and also have the ability to make a quick reasoning on just how to trade a brand-new statement or item of data. You will also need to be able to evaluate whether the news is currently factored into the supply rate and also whether the news matches capitalist expectations.

The drawback is that you require considerable competence in exactly how markets run and exactly how to translate data as well as information - forex spread betting. According to the broker CMC Markets, this style of trading requires much less time dedication than various other trading approaches due to the fact that there is just a need to examine charts at their opening and also closing times.

Forex Spread Betting Fundamentals Explained

The strategy focuses on studying the current day's price compared with the click to read previous day's rate activities, and also making use of that as an overview to exactly how the market is likely to move - forex spread betting. Investors can make use of numerous tools to limit their overnight threat, such as establishing a take-profit order or a stop-loss restriction.They count on signs to establish when a more pattern is taking hold and after that trade on the basis that that trend will proceed. Technical-analysis traders start by looking for to recognize where the cost is heading according to the principles of supply as well as demand.

Likewise, in an uptrend, a line on the chart attaching previous highs will function as resistance when over the current degree, while a line connecting previous lows will certainly function as support with the reverse real in a falling market. Swing trading is a design of trading that focuses on temporary trends in a monetary instrument over a duration of a few days to a number of weeks.

If this is done continually with time, fairly tiny gains can compound right into exceptional yearly returns. Swing traders ought to concentrate on the most proactively traded supplies that reveal a tendency to swing within broad, distinct limits. It's a good idea to concentrate on a choose team of financial instruments, and monitor them daily, to ensure that you recognize the cost action they typically display.

Report this wiki page